![]()

Aside from your own Strata Lot, as an Owner you have an undivided share of common property too. Common property could include any buildings, driveways, fencing, underground and overhead services, as shown on the strata plan. This means you, along with all of the other Owners of your scheme, are responsible for any liabilities that arise from common property ownership.

Insurance Responsibilities as per The Strata Titles Act 1985 WA (STA)

STA outlines the insurance responsibilities for a Strata Company &

Lot Owner under Section 97: Required Insurance. For schemes that fall

under Lots in Single Tier, this is referenced in Schedule 2A Part 5:

Insurance – Schedule 2A, cl.53A-53E.

A Strata Company must insure the insurable assets for the

replacement value, including all fees and charges relating to

construction costs as well as holding a minimum of $10m Legal Liability

Insurance. Workers Compensation Insurance may also be required and this, along with any other insurance determined by the Strata Company.

Strata insurance products will generally be able to cover the

requirements as outlined above.

![]()

Scheme Building and Lot Insurance

Strata insurance will cover the insurable assets as describe by the STA, for which the strata company must insure. This includes

common property and any fixtures and improvements along with “scheme buildings”, which includes parts of the building that does comprise of Lots.

Inside a Lot, strata insurance will extend to cover your fixtures and fittings that are attached to or form part of the building, such as built in furniture that has been nailed, glued, hard-wired or plumbed into the building. This includes paint and wallpaper but excludes carpet and temporary wall, floor and ceiling coverings.

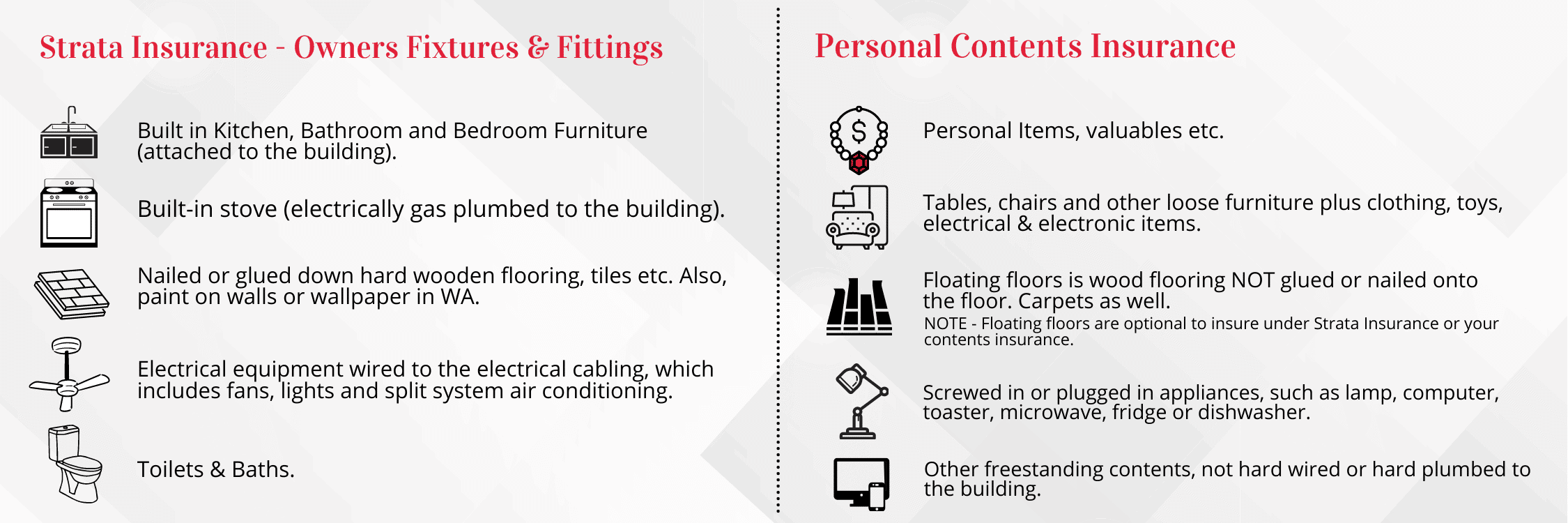

So what are your (Owners) Fixtures and Fittings?

As an Owner, it may be difficult to define what is classified as personal contents and what is classified as a built-in fixture. A great rule of thumb is if it’s attached or fixed to the building, it’s a fixture of the building. If you can pick it up and take it with you, it’s personal contents.

Please refer to the table set below:

Carpets![]()

The STA specifically excludes carpets or other temporary floor, wall or ceiling covering, found inside a Lot. As an Owner you need to ensure your contents insurance covers these items.

*Note that carpets or other fixtures found in

Common Property are covered.

In summary, what does a Landlord Owner or Occupier need to Insure?

As a Landlord Owner or Occupier, you should insure anything deemed as ‘Contents’. This includes things like: Removable contents and chattels, e.g. furniture, personal belongings, temporary fixtures – like floating floors and carpets. Obtaining Contents and Landlords Insurance will include Legal Liability Insurance, which covers negligent exposure arising from the use of your Lot.

*This is not covered by Strata Insurance. Whether you live in or lease out your property to a tenant, it’s important you ensure you have adequate and appropriate insurance protection for either scenario.

![]()

Does your Tenant need Insurance?

A tenant living in Strata should also have Contents Insurance for themselves, similarly to cover their own contents, but also their legal liability. A tenant can become liable to the Strata Company for negligent claims that encroach beyond the confines of the Lot and extend into common property.

![]() What about Commercial Fixtures?

What about Commercial Fixtures?

When it comes to commercial strata, temporary fixtures (i.e. shop fit outs), that are installed inside a Lot and attached to the building for the period of the tenancy are not defined as part of the building and therefore are not covered by Strata Insurance IF they are removable at the end of the lease agreement.

General Disclaimer: This article has been prepared for informational purposes only, and is not legal advice and should not be relied on as legal or insurance advice. You should consult with a qualified insurance or legal advisor. PSC Property Lync Insurance Brokers is an

Authorised Representative (AR 1235681) of Professional Services Corporation Pty

Ltd (AFSL 305491)

![]() Information supplied by PSC Property Lync

Information supplied by PSC Property Lync

Contact PSC on 1300 127 503 or

visit Level 3/10 William St, Perth

www.lyncinsure.com.au